Use the following voucher/transactions for generate reports (You can use more transactions)

| SL No | Descriptions | Amount |

| 1 | Owner Invested from Director Capital (2003) to Company Citi Bank (1151) Account. | 600,000 |

| 2 | Amount received from Citi Bank (1151) to Cash in Hand (1101). | 500,000 |

| 3 | Purchase Furniture – Fixer (1201) from supplier SR Furniture to Furniture as asset | 120,000 |

| 4 | Payment to supplier SR Furniture from Cash in Hand (1101). | 100,000 |

| 5 | Purchase 10 Samsung J2 mobile from Smart Technologies (BD) Ltd by per unit 15000 Taka. Total bill 150000 taka and paid from Cash in Hand (1101) 100000 taka to supplier. |

150,000 |

| Auto paid from Cash to Supplier when purchase invoice entry | 100,000 | |

| 6 | Sales 2 Samsung J2 mobile to the Client Samia Enterprise with price per unit 20000 taka and paid 30000 taka to Cash in Hand (1101) |

40,000 |

| Auto paid to Cash from client when sales invoice entry | 30,000 | |

| 7 | Paid Employee Salary (4201) from Cash in Hand (1101) | 20,000 |

| 8 | Company Billed to Client Samia Enterprise for Sales/Service Income (3001) | 180,000 |

| 9 | Company Paid to Office Rent Expense (4200) | 15,000 |

| 10 | Receive to City Bank (1151) an amount of 150000 by check from Samia Enterprise | 150,000 |

Sign-up (Registration): https://cloud-aps.com/apex/f?p=999:2

Login: https://cloud-aps.com/apex/f?p=trade:101

● Have to Register with your email using below given link

● Login with your email & make transactions (at least 10 vouchers)

● Generate report (Cash Ledger, Trial Balance, Profit & Loss, Balance Sheet)

● Save the report to pdf and send to our official email id (info@cloudsolutonltd.com) mentioning your Enrolment registration full name, email ID and registration serial number

● Which session you have been attended for the practical accounting workshop

● Evaluating the report we shall send the certificate to your email

● If you faced any problem for doing transactions or report then contact us through our official Facebook page inbox (https://www.facebook.com/CloudSolutionLtd)

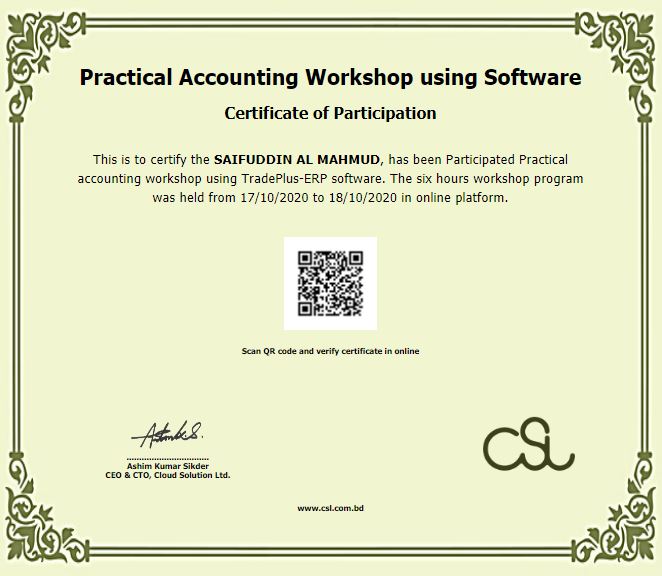

We Provide Certificate Like this.